Approvals rise + Rentvesting gains ground + Buyers look one stop further

Australia’s homebuilding approvals jumped 12% in September from August, offering a glimmer of hope that supply might be starting to catch up with demand.

The latest figures from the Australian Bureau of Statistics show apartment approvals were the main driver, up 26.0% for the month. Detached house approvals also edged up 4.4%.

Over the 12 months to September, 191,695 new homes were approved – the highest annual figure in almost three years.

That’s a positive sign, but we’re not out of the woods yet. According to the National Housing Accord, we need to be building more than 240,000 homes per year to meet our population needs. Right now, we’re around 48,000 a year below that target.

So while it’s encouraging to see approvals trending up, supply is still falling short. That shortfall will likely continue to drive up competition for both rentals and homes to buy.

Rentvesting offers a foot in the door for first-time buyers

For some first home buyers, the dream of owning a home in their preferred suburb still feels out of reach. That’s where rentvesting comes in.

According to the PropTrack–Terri Scheer Investor Report 2025, around 4–5% of investor purchases are made by first-time buyers choosing to rent out their first property rather than live in it. Instead of buying in an unaffordable area, they purchase in a more affordable growth suburb and continue renting where they want to live.

The strategy is most popular in New South Wales, where housing affordability is particularly stretched. It’s less common in Victoria, but still used by buyers looking for a flexible path into the market.

Rentvesting isn’t for everyone, but it can offer a smart way to build equity while preserving lifestyle. With investor activity rising and rents holding firm, more first-time buyers may start exploring this alternative path to ownership.

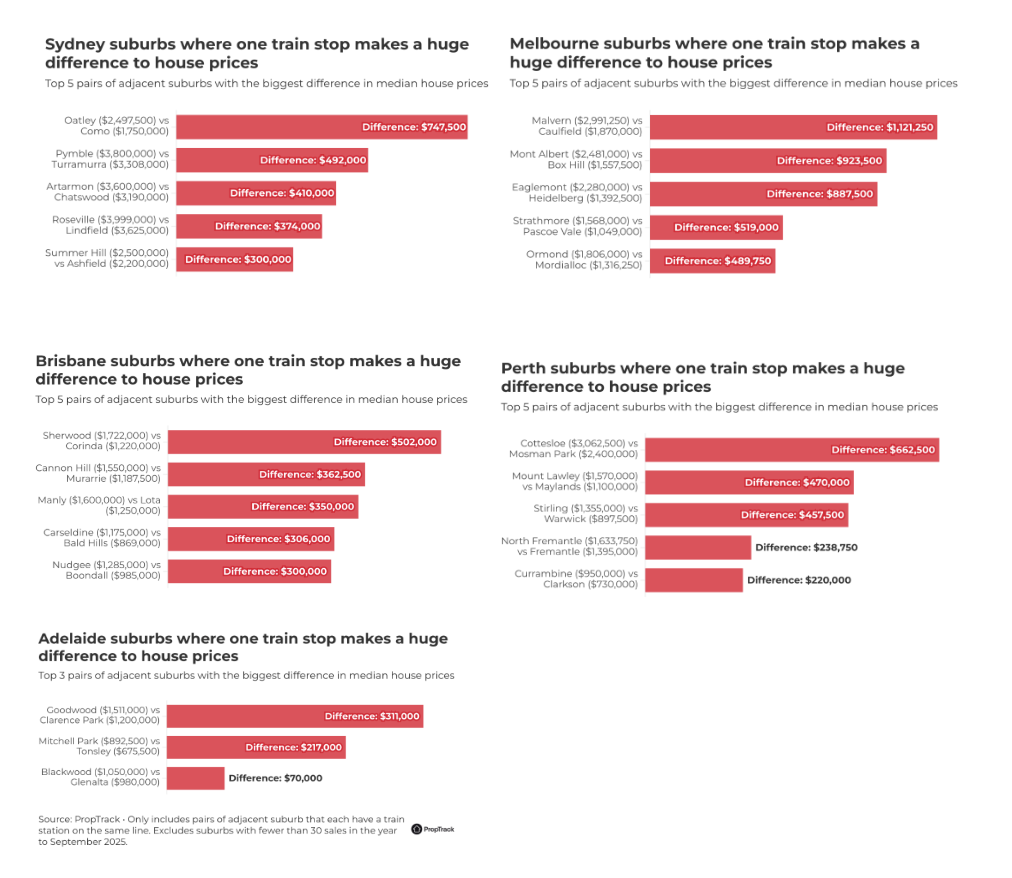

House hunting? Look one stop further

A short train ride could lead to big savings.

PropTrack has found that in many capital cities, buyers can save hundreds of thousands of dollars – even more than $1 million – just by looking one train stop further from the CBD.

The biggest gap was found in Melbourne, where Malvern’s median house price is $2.99 million and Caulfield’s is $1.87 million, a difference of $1.12 million. In Sydney, Como and Oatley are divided by the Georges River and three minutes of train time, but $747,500 in price. Perth’s Cottesloe and Mosman Park show a $662,500 difference. Even in Brisbane, buyers can save over $500,000 by looking just one suburb over.

According to REA economist Eleanor Creagh, land values generally fall the further you move from major employment and lifestyle hubs, though school zones and local amenities can flip the trend.

For budget-conscious buyers, this research is a reminder that smart trade-offs such as a slightly longer commute can unlock big value.