Property set to surge + DTI caps loom + 12% homes affordable

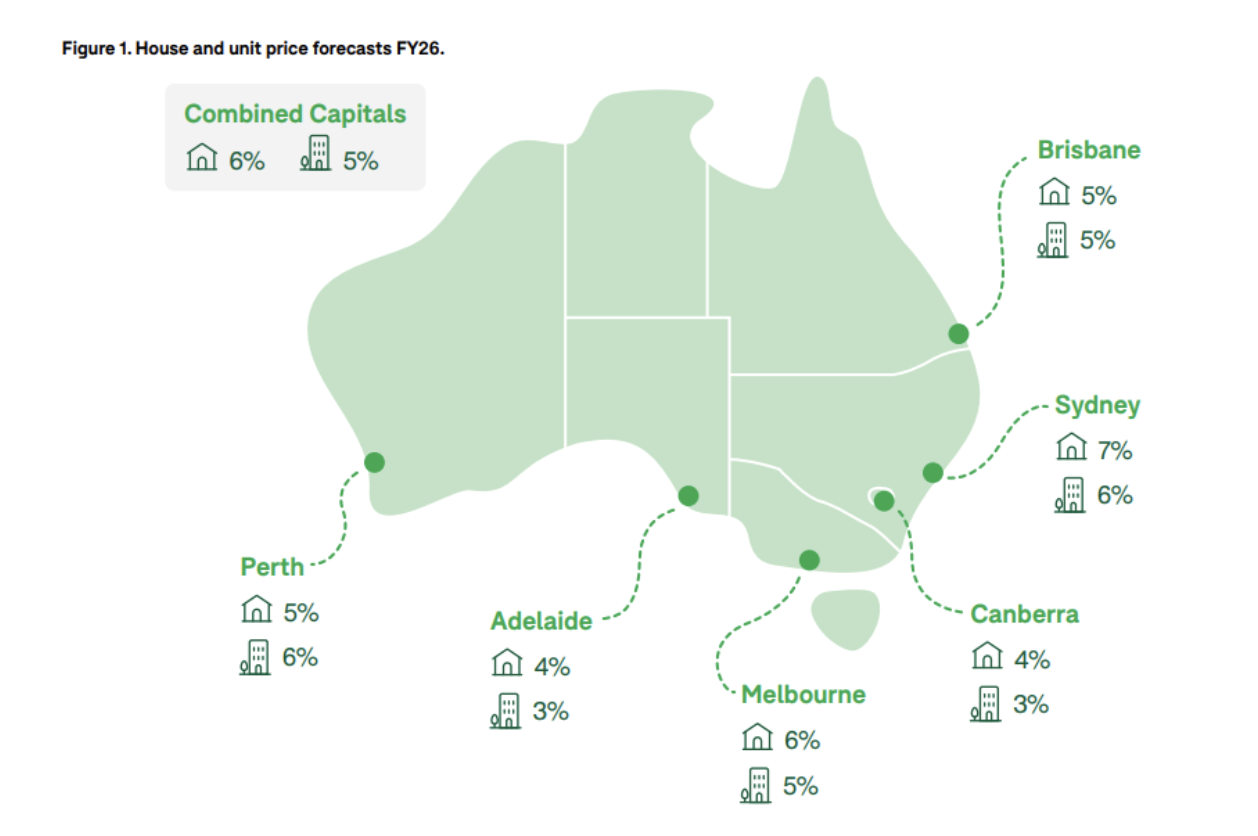

SQM Research is forecasting a strong year ahead for the housing market, with interest rate cuts from mid-2026 expected to trigger a new wave of buyer demand. That’s likely to push prices sharply higher in cities where supply remains tight and economic conditions are solid.

In its Boom and Bust Report 2026, SQM tips national home values to rise 6–10%, with several capitals expected to outperform.

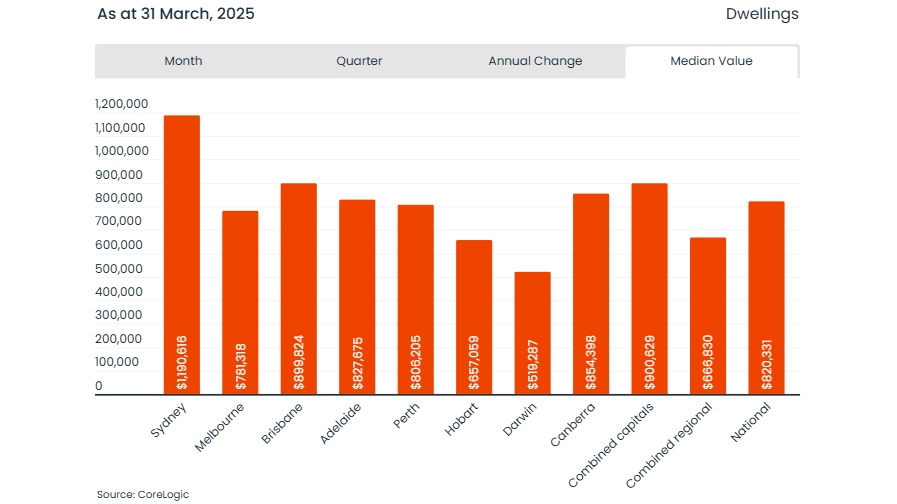

Perth is forecast to lead the market, with prices rising 12–16%, followed by Darwin (12–16%), Brisbane (10–15%) and Adelaide (10–14%). Based on current medians, that would push Perth’s median above $1 million and Brisbane’s close to $1.1 million

Even in softer markets like Melbourne, Hobart and Canberra, values are expected to increase between 3% and 7%.

SQM’s base case assumes moderate population growth, a small surplus of completions and one or two interest rate cuts in the second half of the year. But even if cuts are delayed, prices are still forecast to rise across all capitals – with the biggest gains in Brisbane, Perth and Adelaide.

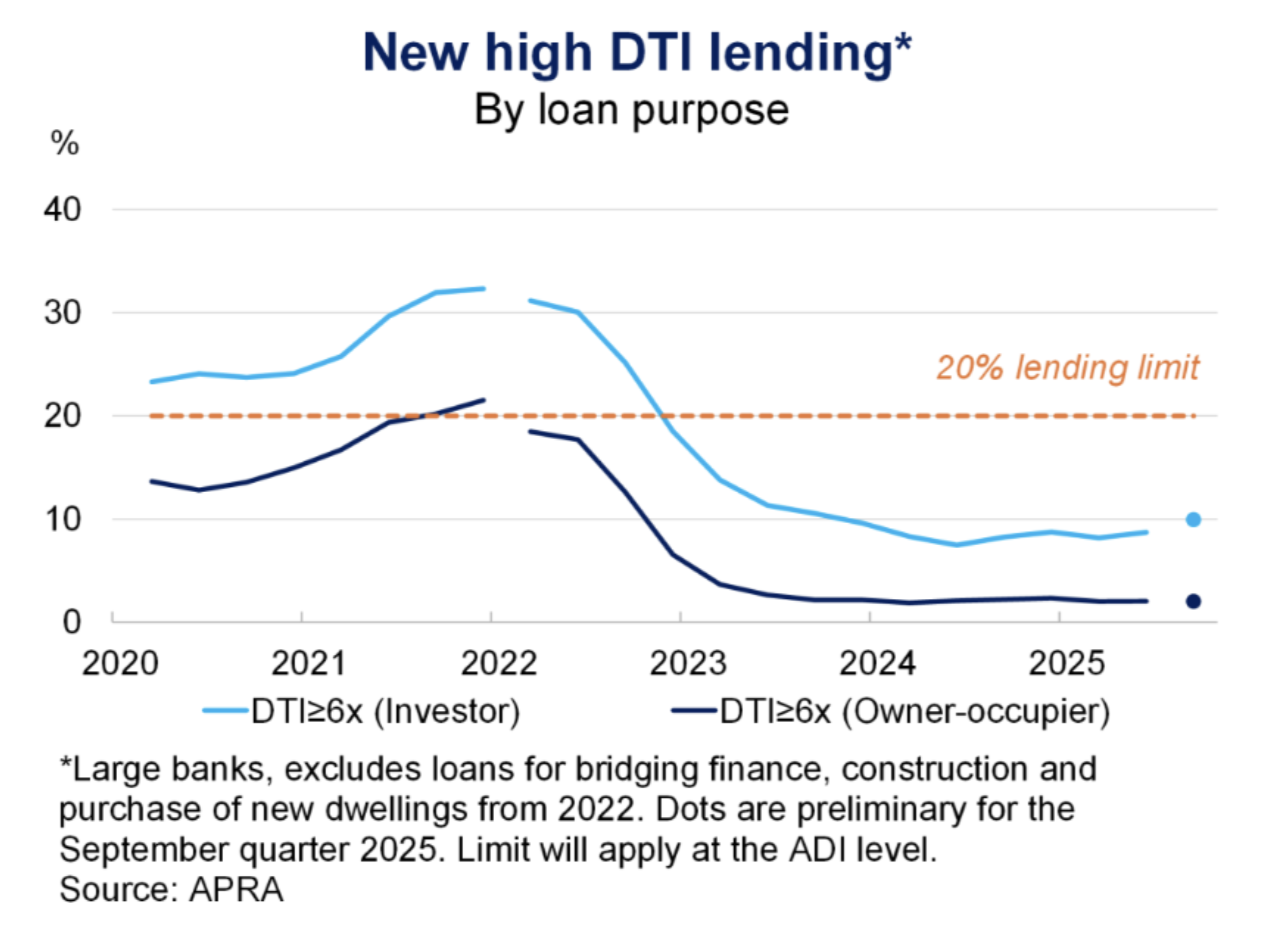

High DTI loans to be capped from February

APRA, the banking regulator, will limit the share of high debt-to-income (DTI) lending from 1 February to keep financial risks in check. Banks will be allowed to write no more than 20% of new loans at a DTI of six or above.

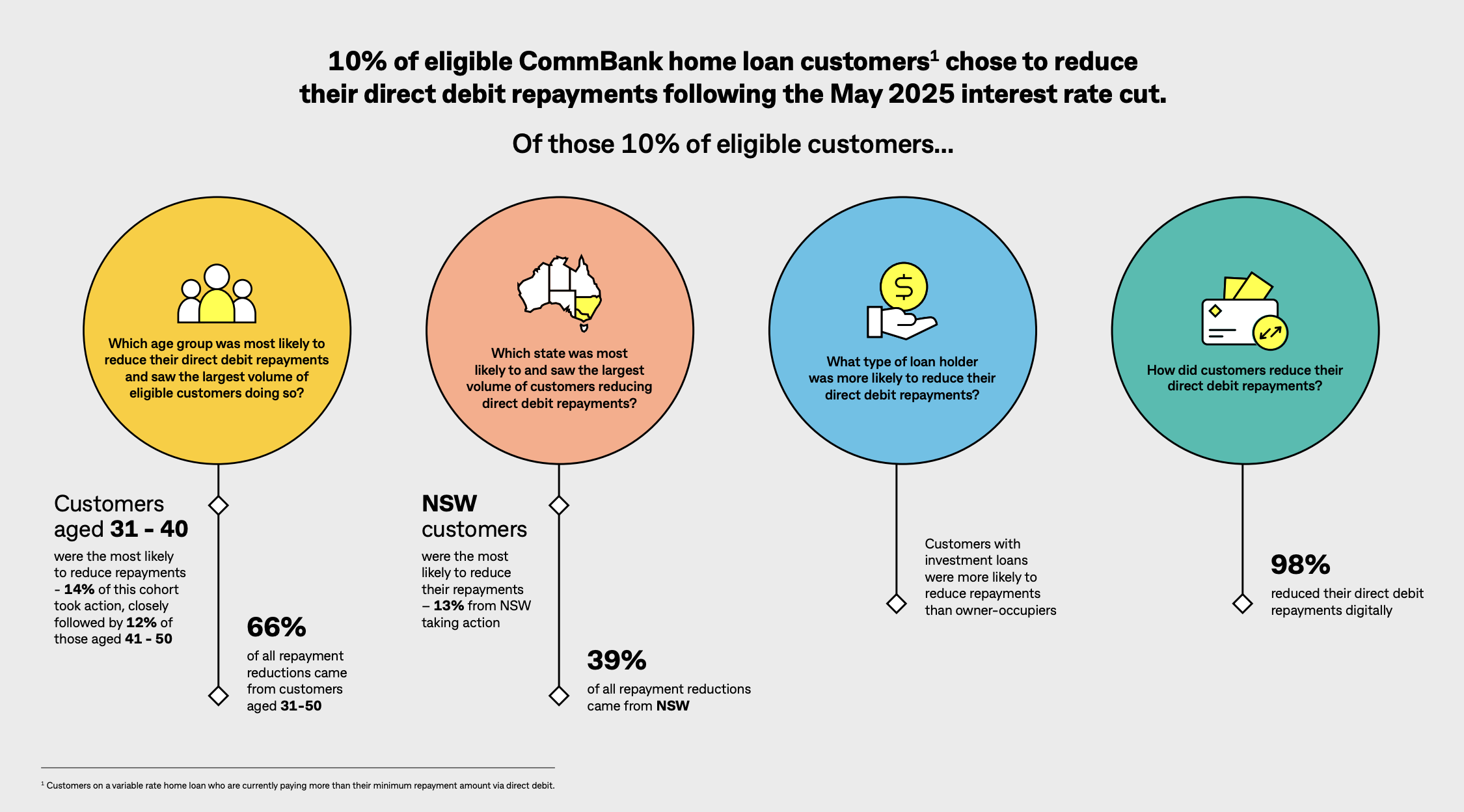

The move reflects concern about rising household debt as the market heats up. Interest rate cuts this year have lifted borrowing capacity and credit growth is running above its long-term average. At the same time, investor lending has surged, with new investor loans growing at about triple the pace of owner-occupier loans.

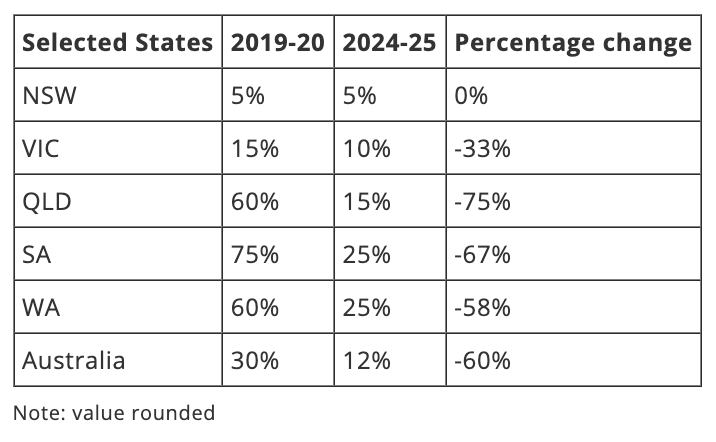

APRA said high DTI lending is still relatively low overall, but has begun to rise and is increasingly concentrated among investors (see image). In past cycles, this type of borrowing has been linked to easing credit standards and rapid price gains.

The cap will not apply to bridging loans or loans for new builds, to avoid slowing housing supply.

By acting early, APRA hopes to stop household debt from climbing to levels that could weaken financial stability later in the cycle.

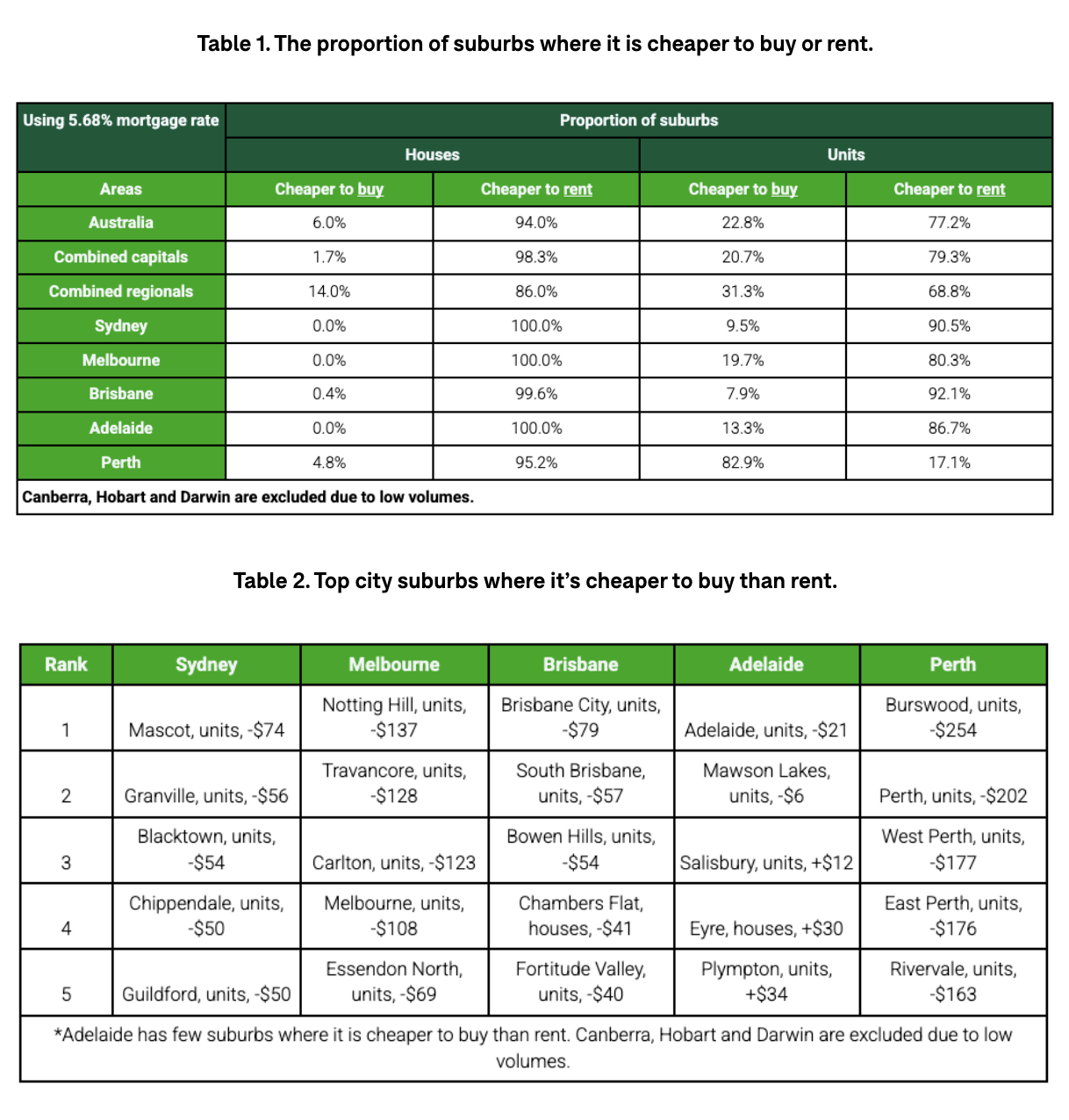

Just 12% of homes are affordable for first home buyers

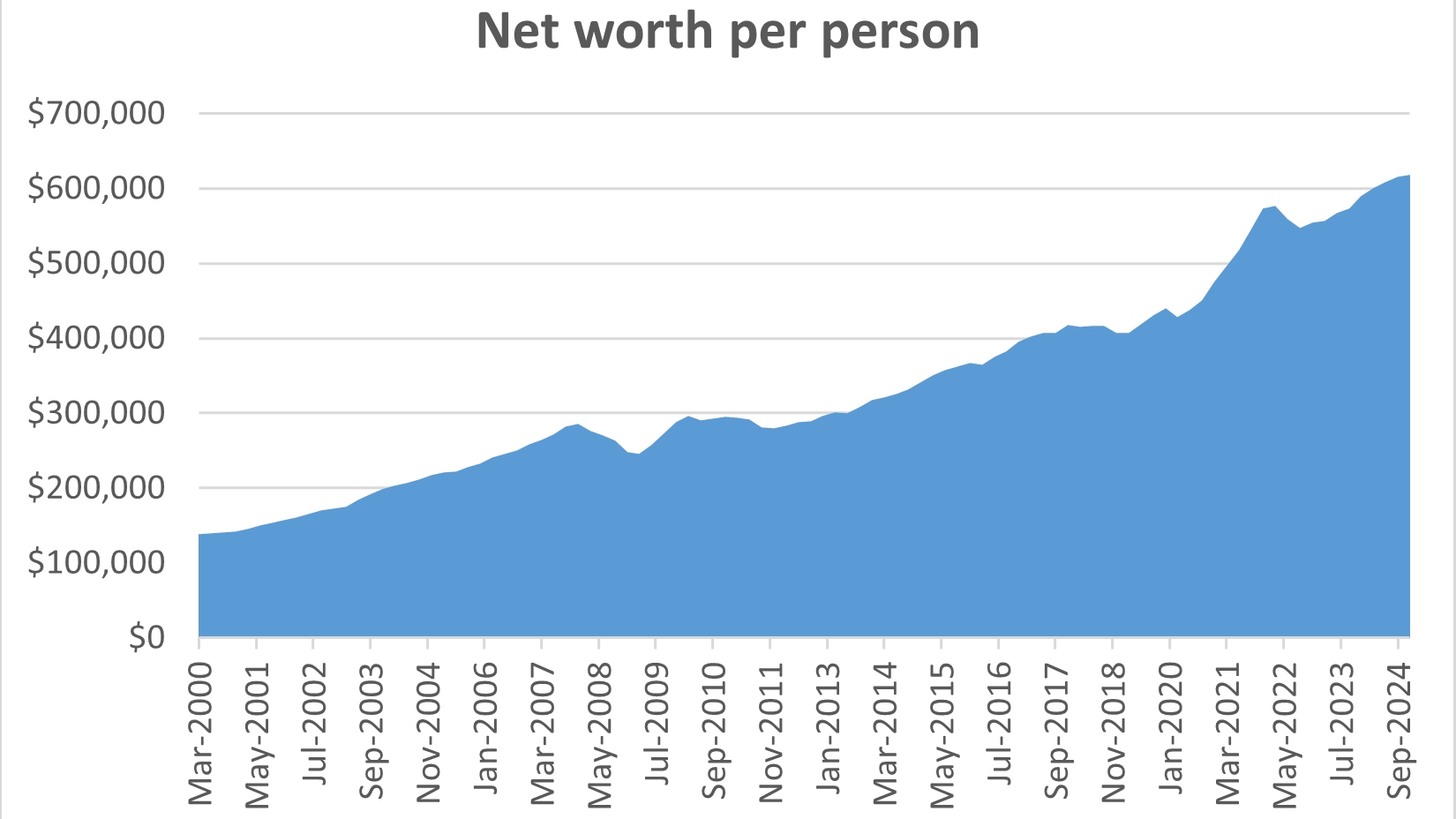

Housing has become significantly less affordable for first home buyers, according to new analysis from KPMG.

Back in 2019–20, buyers earning $150,000 could afford about 30% of the market. Today, a household earning $180,000 can only afford 12%.

That decline has been driven by soaring property prices. Since 2020, the median has jumped 80% in Queensland and South Australia, 75% in Western Australia, 40% in New South Wales and 20% in Victoria.

In South Australia, a quarter of homes are still within reach, but that’s down from 75% just five years ago. In NSW, affordability has flatlined at 5%.

The share of affordable new homes is also shrinking. Only 12% of new housing supply in 2024–25 was priced under $800,000, compared to around 33% in 2022–23.

As affordability falls, many first home buyers are targeting regional areas, smaller apartments or new fringe developments. But competition is tight, and the pool of entry-level stock continues to shrink.